what is fsa/hra eligible health care expenses

This publication ex-plains the following programs. Adoption fees associated with and medical expenses for adopted child The expenses associated with the adoption of a child are not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA limited-purpose flexible spending account LPFSA or dependent care flexible spending account.

FSA is flexible spending account or arrangement.

. Health Savings Accounts HSAs. Send a pharmacy receipt showing the prescription details and purchase information. For a complete list of IRS-qualified medical expenses visit irsgov or view a list of qualifying examples.

It is not eligible for reimbursement from an FSA HRA or HSA. HSAs HRAs and FSAs are accounts used to save on taxes and pay for qualified medical prescription dental and vision expenses. 3 how our provider referral process works.

CARES Act Expands Eligible Expenses to Include OTC and Feminine Hygiene Products - 3272020 The Coronavirus Aid Relief and Economic Security CARES Act was signed into law on Friday March 27th. It is available for your review upon request and explains 1 Who participates in our provider network. From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and more will be here complete with details and requirements.

One component of the law was an expansion of products eligible for reimbursement from health savings accounts HSAs and medical flexible spending. Preschoolnursery school for pre-kindergarten. Also most states recognize HSA funds as tax-deductible with very few exceptions.

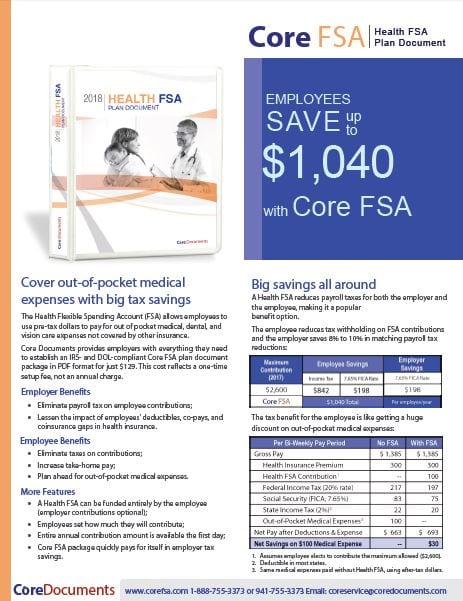

Over-the-counter OTC drugsproducts. Health Flexible Spending Arrangements FSAs. HSA Health FSA and HRA Eligible Expenses ConnectYourCare 2021-12-22T101136-0500 There are thousands of eligible expenses for tax-free purchase with a Health Savings Account HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRAincluding prescriptions doctors office copays health insurance.

Transportation to and from eligible care provided by your care provider. Please consult a tax advisor regarding your states specific rules. 2 how we ensure that the network meets the health care needs of our members.

Health Reimbursement Arrangements HRAs. Registration fees required for eligible care after actual services are received Sick-child care center. Out-of-Pocket Uncovered Medical Care Expenses.

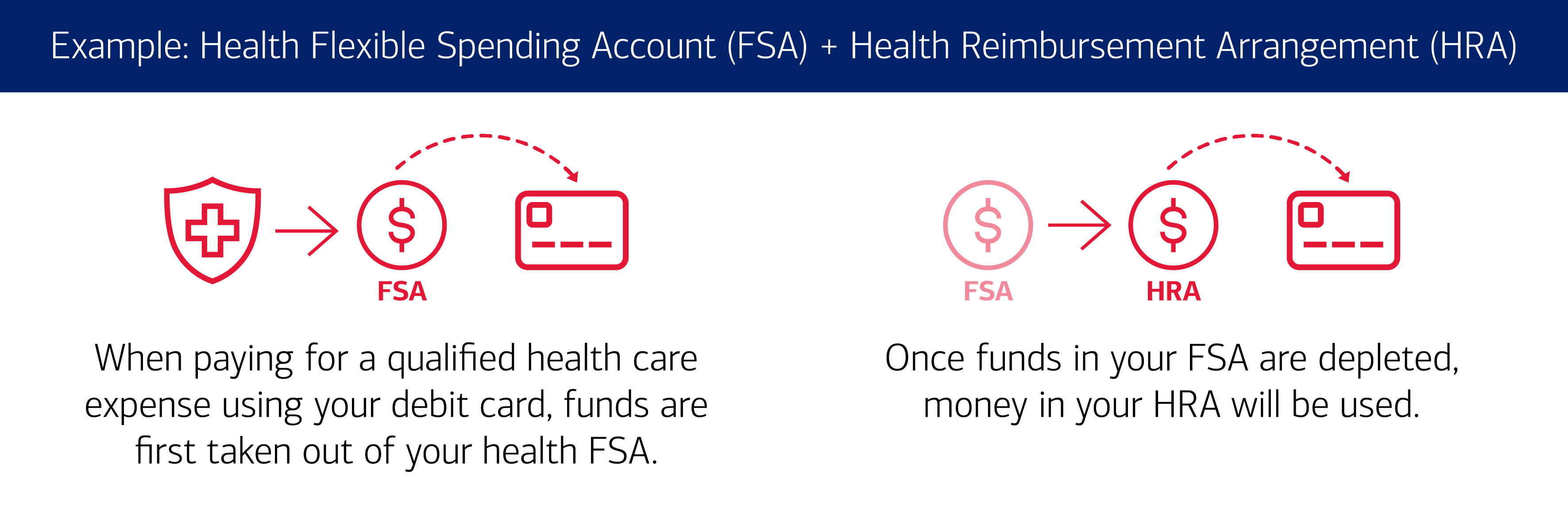

To determine if the below listed expenses can be paid by your HRA please refer to your. If you have a Flexible Spending Account FSA or Health Reimbursement Account HRA you can submit your claim and eligible expenses. Eligible expense scanner on the MyHealth mobile app Our new barcode scanner takes the guesswork out of what items the IRS considers qualified expenses.

5 what steps we take to ensure medical quality and customer. Your employer determines which health care expenses are eligible under an HRA. This includes deductibles co-insurance prescriptions dental and vision care and more.

By selecting an HSA-qualified plan you are eligible to contribute tax-free money into a health savings account HSA. Guidance for eligible expenses is included in IRS Publication 502 Medical and Dental Expenses. Doc Additional documentation required.

Transit Account A Transit Account enables you to set aside funds on a pre-tax basis to pay for eligible workplace mass transit expenses such as the price of tickets vouchers and passes to ride a subway train or city bus or the costs of transportation in a commuter highway vehicle eg vanpool if such transportation is for purposes. Medical Savings Accounts Archer MSAs and Medi-care Advantage MSAs. RxMN Eligible for reimbursement with a Doctors NotePrescription for products or a Medical Necessity form for services.

The IRS decides which products and services are eligible for purchase or payment using FSA funds. In addition your HSA contributions earn tax-free interest and carry over from year-to-year even if you change jobs or retire. 4 how care is continued if providers leave our network.

Limited Medical FSAHRA Plan participants should check their Plan Highlights to see if OTC items are eligible. Thankfully HSAs and FSAs exist to help parents offset the cost of medical expenses for their kids and themselves and there is a long list of items and services that are. HSA and FSA Eligible Expenses for Mom Baby and Parents-to-be Parenting and motherhood are some of the greatest joys in life but it does require some financial planning.

An HSA may receive contributions from an eligible indi-. Payroll taxes related to eligible care. Your HSA funds can then be used tax-free to pay for qualified medical expenses.

HRA is health reimbursement account or arrangement. 1 HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. SAMPLE CHART OF ELIGIBLE EXPENSES Please note that this is not a complete list but is intended to provide Plan participants with examples to help determine what OTC items may be an eligible expense.

This is a letter from your health care provider that includes a recommendation of the item or service to treat your diagnosis and the duration of the recommendation. Learn how a health savings account HSA works to determine which health savings plan may be right for you. To determine if the FSA expenses you wish to submit are eligible check the list below.

Medical expenses are the costs of diagnosis cure mitigation treatment or prevention of disease and the costs for treatments affecting any part or. Eligible Eligible for reimbursement. Copays Coinsurance Deductible expenses.

Just open the MyHealth mobile app select Eligible Expense Scanner from the menu then simply scan the item barcode to find out if it can be paid for using your health account. Here it is the most-comprehensive eligibility list available on the web. You can pay for a wide range of IRS-qualified medical expenses with your HSA including many that arent typically covered by health insurance plans.

Please see your benefit plan documents to find out which health care expenses are eligible under your HRA. HSA is health savings account. Tips for common FSAHRA claims.

Eligible expenses in an HRA will vary depending on plan design. In addition if your. Vantages to offset health care costs.

Health Care And Dependent Care Fsas Infographic Optum Financial

Which Expenses Qualify For Tax Free Treatment

Comparing Hsas Hras And Fsas Which Approach Is Best Exude

Can I Pay For Mental Health Care Using My Fsa Or Hsa

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Limited Purpose Fsas Combining Hsas And Fsas Infographic

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Hsa Fsa And Hra Eligible Expenses Cigna Health Savings Account Health Care Expensive

Using Your Health And Benefit Visa Debit Card

Hsa Vs Fsa What S The Difference Quick Reference Chart

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

What Do I Need To Know About Fsas And Hsas One Medical

What Is A Dependent Care Fsa Wex Inc

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive

Hsa Vs Fsa Which Is Better Comparison Chart Included Health Savings Account Flex Spending Account Health Insurance Humor